Key takeaways from webinar: Fintech Capital London

Date: 10 October 2024

Author: FINTECH Circle

On October 9, 2024, FINTECH Circle hosted an insightful webinar titled, “Fintech Capital London: How the New Listing Rules & the CMIT Reform Will Boost the Fintech Sector.” The session was led by Susanne Chishti, Founder & Chair of FINTECH Circle, alongside guest speaker Mark James, a renowned expert in financial regulations.

A Deep Dive into the New Listing Rules

Susanne Chishti opened the discussion by highlighting the UK’s commitment to becoming the world’s leading fintech hub, stressing that regulatory reforms are at the core of this mission.

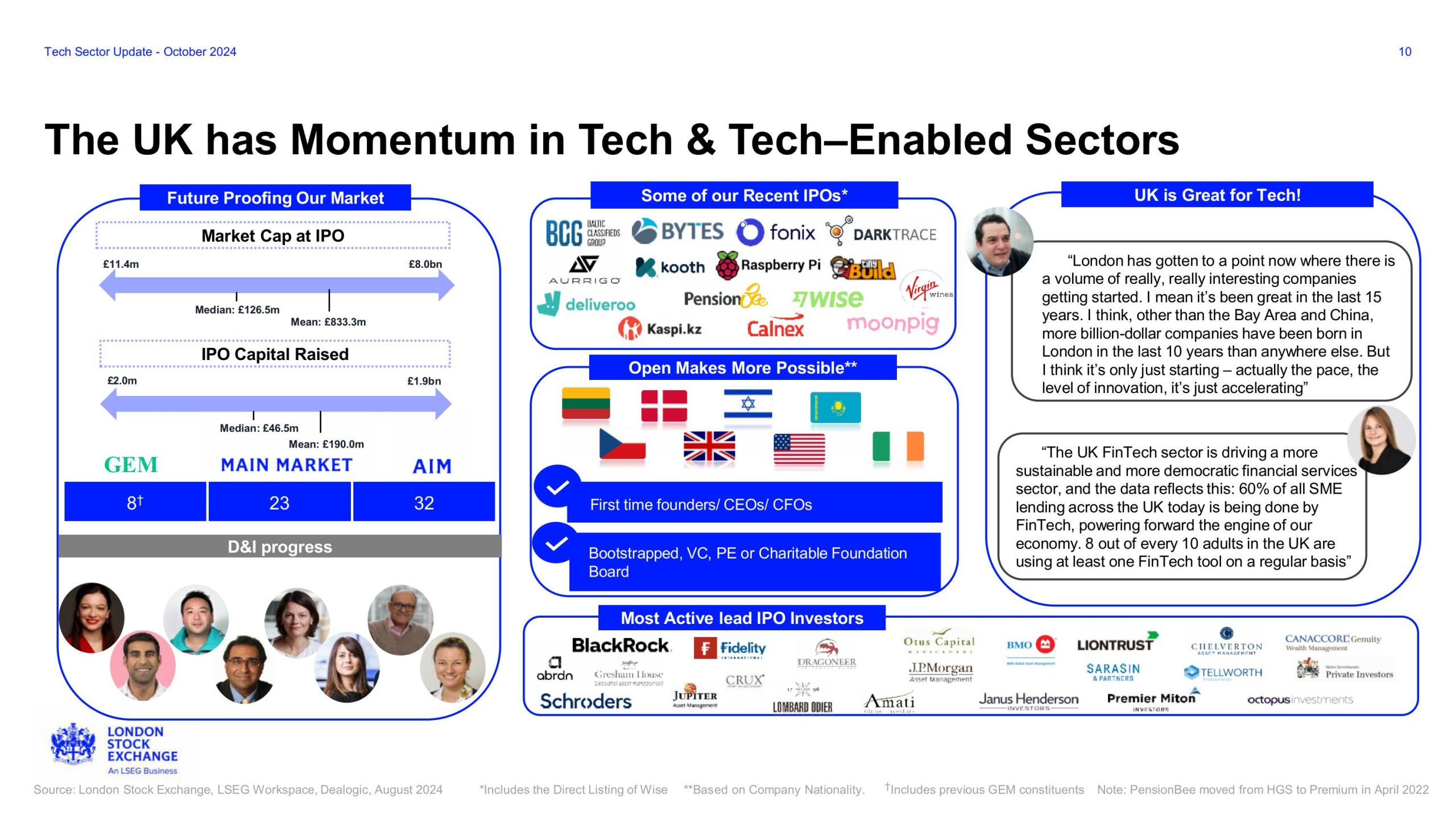

She explained that the new listing rules offer greater flexibility and inclusivity for high-growth fintech firms. With fewer barriers to going public, these regulations are designed to encourage more fintech companies to consider listing on the London Stock Exchange.

Mark James followed up by analyzing the specifics of these rules. He pointed out that the revised framework not only simplifies the process but also reduces compliance costs, making it easier for smaller and medium-sized fintech firms to access public markets.

According to Mark, this shift will likely attract both domestic and international fintech players to London, providing an alternative to other global financial centers.

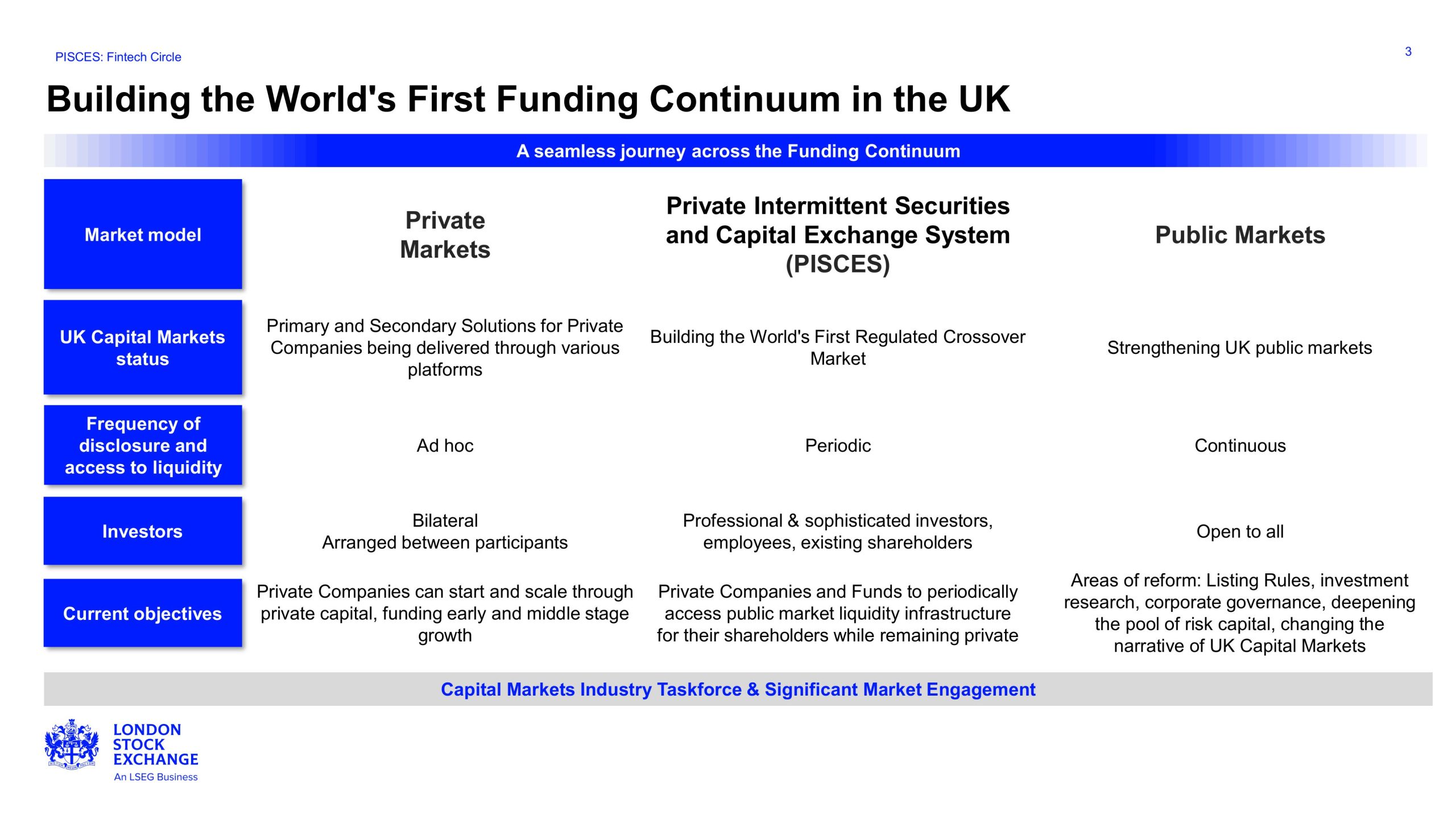

The CMIT Reform: A Game-Changer for Fintech Investment

Moving on to the Capital Markets Investment Taskforce (CMIT) reform, Susanne described it as a pivotal development that will enhance investment flows into the fintech sector. This reform aims to create a more investor-friendly environment by introducing incentives for private and institutional investors to back innovative fintech companies.

Mark James elaborated on how the CMIT reform aligns with the UK’s broader economic goals. By offering new investment vehicles and tax benefits, the reform seeks to address the gap between early-stage funding and later-stage growth capital, a challenge that many fintech startups face.

He believes that this reform will strengthen the UK’s position as a magnet for venture capital and private equity funding, accelerating the growth of its fintech ecosystem.

International Implications and Global Competitiveness

Throughout the conversation, both speakers underscored the international ramifications of these changes. Susanne emphasized that these reforms not only position London as a more attractive destination for fintech listings but also enhance its global competitiveness.

She noted that, in an increasingly interconnected world, these regulatory changes are critical to ensuring that London remains a leader in financial innovation.

Mark James concurred, adding that the CMIT reform and the new listing rules send a strong message to international markets. He believes that with these changes, London can attract a more diverse set of fintech companies from around the world, further cementing its reputation as a global fintech capital.

Future Outlook: What’s Next for Fintech?

As the webinar drew to a close, both the speakers discussed the future of the fintech sector. Both agreed that the regulatory reforms are just the beginning of a larger movement toward a more resilient and innovative financial ecosystem in the UK.

Susanne predicted that the next wave of fintech innovation would come from enhanced collaboration between fintechs and traditional financial institutions, fueled by the new regulations.

Mark concluded with an optimistic outlook, stating that the fintech sector is poised for unprecedented growth. He encouraged fintech founders and investors to seize the opportunities presented by these reforms, particularly as London continues to solidify its standing as a global fintech powerhouse.

Here are the key takeaways:

- New Listing Rules Lower Barriers: The UK’s revised listing rules offer greater flexibility and lower compliance costs, making it easier for fintech firms to go public on the London Stock Exchange.

- CMIT Reform Enhances Investment: The Capital Markets Investment Taskforce reform introduces incentives to boost private and institutional investment in fintech, bridging the funding gap for growth-stage companies.

Global Competitiveness: These regulatory reforms strengthen London’s position as a global fintech hub, attracting both domestic and international fintech players.

Future of Collaboration: Fintech innovation is expected to accelerate through greater collaboration between fintech companies and traditional financial institutions.

Growth Opportunities: The evolving regulatory landscape presents significant opportunities for fintech founders, investors, and stakeholders to scale and innovate within a supportive ecosystem.

Watch the Full Webinar On-Demand below 👇👇👇